How to report federal return.

Capital gains tax 2017 california.

What you need to know for 2017 here s how your capital gains tax rates may be changing for 2017 and how to prepare.

California taxes all capital gains as income unlike the federal government which differentiates between long term and short term capital gains.

By paying 23 8 plus 13 3 californians are paying more on capital gain than virtually.

However the golden state also has one of the highest costs of living in the u s and californians pay some of the highest capital gains taxes in the entire world.

Long term capital gains on so called collectible assets.

Individual income tax return irs form 1040 or 1040 sr and capital gains and losses schedule d irs form 1040 or irs form 1040 sr.

When a capital asset is sold the difference between the basis in the asset and the amount it is sold for is a capital gain or a capital.

1 examples are a home household furnishings and stocks or bonds held in a personal account.

If you have a difference in the treatment of federal and state.

If you own a home you may be wondering how the government taxes profits from.

Almost everything owned and used for personal or investment purposes is a capital asset.

The current 2017 capital gains tax rates.

The capital gains tax rates in the tables above apply to most assets but there are some noteworthy exceptions.

2017 capital gains rates.

The federal tax rate for your long term capital gains are taxed depends on where your income falls in relation to three cut off points.

Short term capital gains are profits made on investments you sell that were held for one.

First of all there are two types of capital gains tax rates.

California is known the world over for its picture perfect beaches and sunny weather.

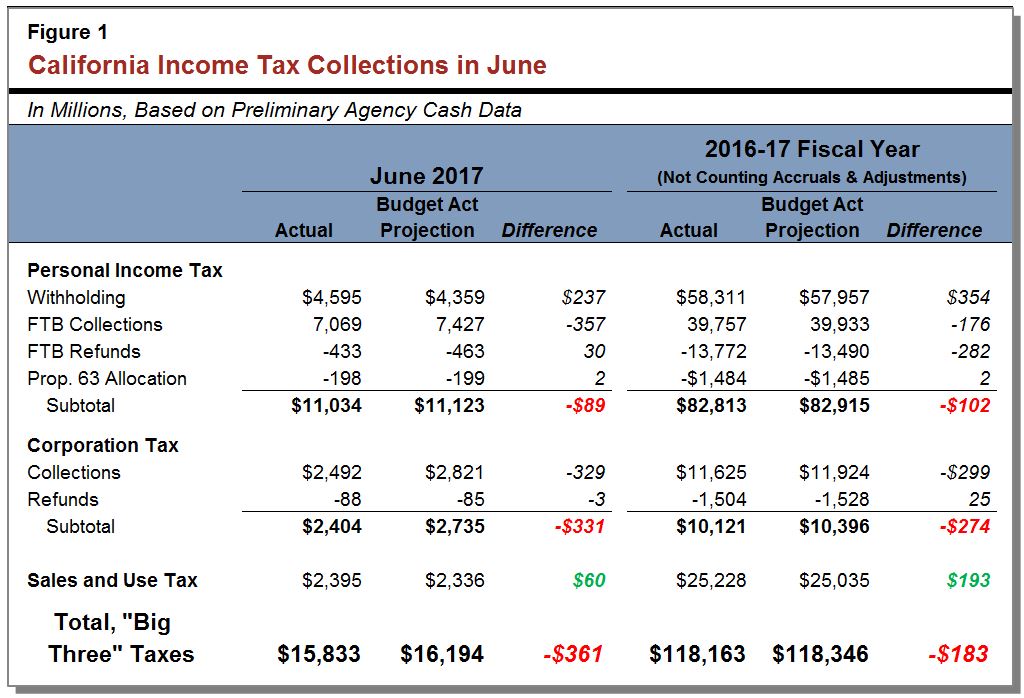

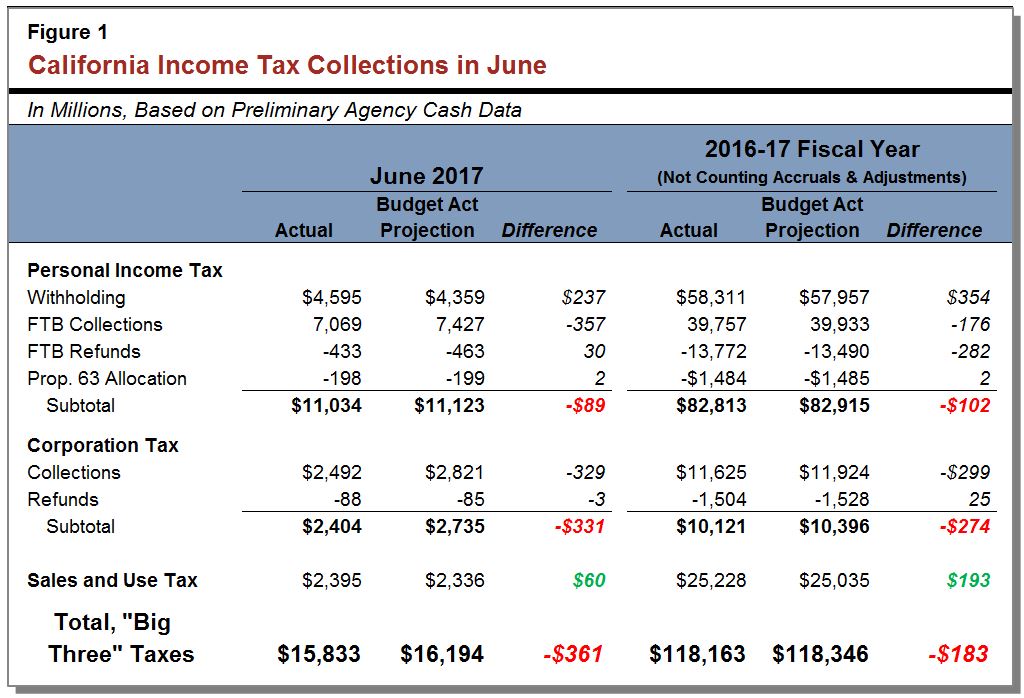

A good capital gains calculator like ours takes both federal and state taxation into account.

Capital gains taxes on property.

2017 long term capital gain rates 0 if your income is below 37 950 and you are filing as single or below 75 900 for married filing jointly.

The usual high income tax suspects california new york oregon minnesota new jersey and vermont have high taxes on capital gains too.

California does not have a tax rate that applies specifically to capital gains.

All capital gains are taxed as ordinary income.

To report your capital gains and losses use u s.

Instead capital gains are taxed at the same rate as regular income.